Digital Tax Bill is Wanting

By Atty. Irwin C. Nidea Jr.

"Digital taxation is an unchartered territory with several issues and factors to consider. Enforcement will be critical but equally challenging due to the volume of transactions. It is a welcome development that the bill is trying to address the VAT liability of the players of the digital economy. But it must also not shy away in pushing for an equitable income tax share for our country."

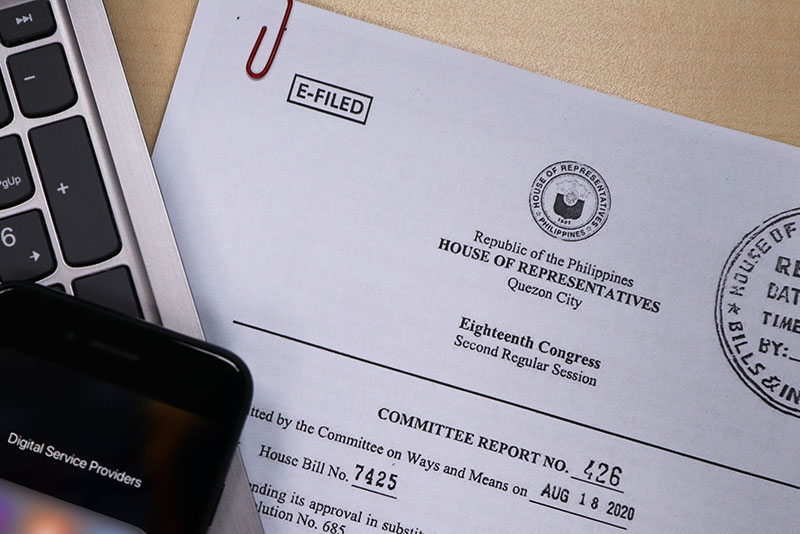

The digital economy presented new challenges as the current tax rules is contemplated to apply only on brick-and-mortar establishments and not on new disruptive business models. To address this, the House of Representatives recently approved the bill (HB 7425) amending the VAT law to expressly include in its coverage goods which are electronic in nature and services rendered electronically as well as digital services.

As an added measure to fuel the economy, the bill further clarified which digital goods and services traded through digital service providers will be subject to VAT. These include:

• Electronic market place (e.g., Lazada, Shoppee, Facebook Marketplace)

• Electronic market place (e.g., Lazada, Shoppee, Facebook Marketplace)

• Online auctions

• Supplier of digital / streaming services in exchange for a regular subscription fee (e.g., Netflix, Spotify)

• Online licensing of software, updates and add-ons, website filters and firewalls

• Mobile applications, video games and online games

• Webcast and webinars

• Digital content such as music, files, images, text and information

• Online advertising spaces, search engine services, social networks, database and hosting, online training

• Payment processing services (e.g., Gcash, Paymaya)

The bill also provisioned exempt transactions which include:

• Books and other printed materials sold electronically or online

• Online courses and webinars rendered by private educational institutions, duly accredited by the DepEd, CHED and TESDA, among others

Nonresident Digital Service Providers (nonresident DSP) which include Amazon and Netflix, are liable to register for value-added tax (VAT) if:

a. Gross sales/receipts for past twelve (12) months before date of filing for VAT return, other than those considered as exempt, exceeded P3 Million; or

b. Reasonable grounds to believe that gross sales/receipts for next 12 months from date of filing VAT return, other than those considered as exempt, will exceed P3 Million

The registration requirement for a nonresident DSP is conditioned on the establishment by the BIR of a simplified automated registration system. The implementing rules and regulations are still being developed and will be issued by the Department of Finance (DOF) upon the recommendation of the BIR and in coordination with the Department of Information and Communications Technology (DICT).

Amazon, for example may be required to register as a VAT entity if it reaches the threshold enumerated above. It has international sellers generating income from Filipino consumers through its digital platform. The services are essentially rendered in the Philippines by non-resident foreign proprietors. Will they be subject to tax?

They will be subject to VAT. To capture these sales, the bill proposes to widen the coverage of current administrative tax issuances dealing with the taxation of online businesses and transactions by specifically requiring nonresident digital service providers to register for VAT. Amazon for example is now responsible for assessing, collecting, and remitting the VAT on the transactions that go through its platforms.

What is glaringly missing though is a provision on income tax. The bill only addressed the liability of non-resident DSPs as far as VAT is concerned but it is erringly silent on the income tax liability of a nonresident DSP like Amazon and Netflix.

Our country must participate in international discussions on the income taxation scheme that must be applied on cross-border digital services transactions. We must be proactive in protecting our share as a consumer driven economy on the allocation of income tax.

Understandably, the home country of the non-resident DSPs wants more share of the income tax pie. But we must make sure that our country secures its fair share of the pie. The consumer as well as the actual sale of the goods and services are performed in the country. We should not only be content on imposing VAT to these nonresident DSPs. We must also make sure that they pay the proportionate income tax that is due for our country.

Digital taxation is an unchartered territory with several issues and factors to consider. Enforcement will be critical but equally challenging due to the volume of transactions. It is a welcome development that the bill is trying to address the VAT liability of the players of the digital economy. But it must also not shy away in pushing for an equitable income tax share for our country.

The author is a senior partner of Du-Baladad and Associates Law Offices, a member-firm of WTS Global.

The article is for general information only and is not intended, nor should be construed as a substitute for tax, legal or financial advice on any specific matter. Applicability of this article to any actual or particular tax or legal issue should be supported therefore by a professional study or advice. If you have any comments or questions concerning the article, you may e-mail the author at This email address is being protected from spambots. You need JavaScript enabled to view it. or call 8403-2001 local 330.